Introduction

Airtel Uganda has sweetened the IPO deal by increasing the incentive shares for most categories of investors. Retail investors can now get 10 additional incentive shares for every 100 shares allocated. Retail investors who buy offer shares through m-IPO Airtel Money Platform get one additional share for every 100 allocated. This means the effective offer price is ugx 90.09 instead of ugx 100, which gives you a discount of about 10%.

Recall that the IPO was extended by two weeks and will close on Friday, 27th October 2023.

Analysis of ugx 1m investment for a retail investor

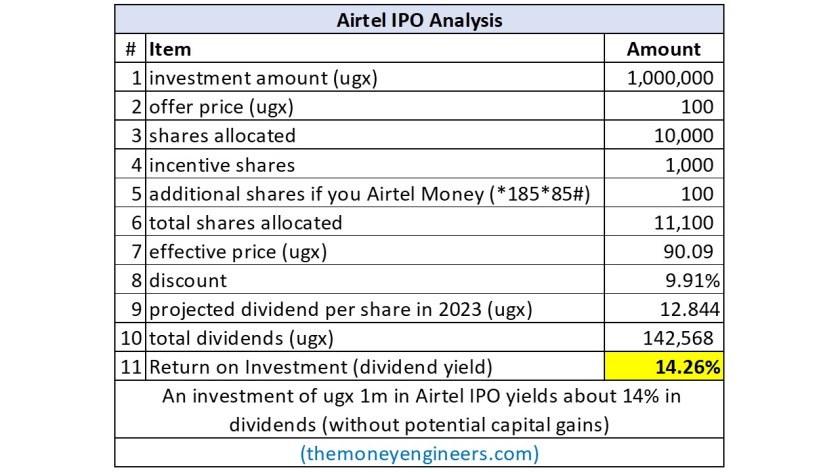

Here’s a breakdown of the Airtel IPO Analysis based on an investment amount of ugx 1m for a retail investor as presented in the table:

1. Investment Amount (UGX):

– I assume that an investor is planning to invest 1,000,000 UGX (Ugandan Shillings) in the Airtel IPO.

2. Offer Price (UGX):

– The price at which Airtel shares are being offered to the public is 100 UGX per share.

3. Shares Allocated:

– For the invested amount, the investor will be allocated 10,000 shares (1,000,000 UGX ÷ 100 UGX/share).

4. Incentive Shares:

– On top of the shares purchased, the investor is given an additional 1,000 shares as a bonus or incentive. (i.e. (10,000/100)*10)

5. Additional Shares if you Airtel Money (*185*85#):

– If the investor uses Airtel Money (a mobile money service) for the transaction, they will receive another 100 shares. (i.e. (10,000/100)*1)

6. Total Shares Allocated:

– The total number of shares the investor will receive, combining the allocated shares, incentive shares, and additional shares from using Airtel Money, is 11,100 shares. (i.e. 10,000 shares + 1000 bonus shares + 100 additional shares through Airtel Money)

7. Effective Price (UGX):

– Taking into account the incentive and additional shares, the effective price the investor pays per share drops to 90.09 UGX. This is calculated by dividing the investment amount by the total shares (1,000,000 UGX ÷ 11,100 shares).

8. Discount:

– Due to the incentive and additional shares, the investor is getting a 9.91% discount on the original offer price. (i.e. (1 – 90.09/100)*100%)

9. Projected Dividend per Share in 2023 (UGX):

– It is projected that for each share, a dividend of 12.844 UGX will be paid out in 2023. (i.e. ugx 513.76bn in profits/40bn shares issued)

10. Total dividends is about ugx 142,568 in 2023. (i.e. 11,100 shares multiplied by ugx 12.844 dividends per share)

11. Return on Investment (Dividend Yield):

– The expected return on investment, based solely on dividends (without considering potential capital gains from share price appreciation), is 14.26%. This suggests that by holding these shares, the investor can expect a 14.26% yield on their investment from dividends in 2023. (i.e. (12.844/90.09)*100%)

Conclusion

In summary, investing 1 million UGX in the Airtel IPO provides the investor with a total of 11,100 shares at an effective discounted price of 90.09 UGX per share. The projected dividend yield for 2023 is 14.26% (or 12.12% after removing 15% withholding tax), making it a potentially lucrative investment if the projections hold. Remember that unit trusts are earning about 11% without any potential for capital gains!

You have done such a fantastic job explaining this IPO mechanics. Surely whoever reads this and still does not understand should try their talents (if any) elsewhere. It is better explained than what the issuer has done so far!!!👍🏿👍🏿👍🏿

LikeLike