By Eddie Mugulusi

So here’s the story.

A client of mine runs a nail parlor. Business was good. Nothing too crazy, but steady, loyal customers.

Then one day, a new competitor rolled in. And not just any competitor—the fanciest, flashiest, biggest nail parlor the town had ever seen. Marble floors, golden chairs, LED mirrors… the works.

It screamed money.

My client panicked. Called me, worried. “Eddie, I think I’m done. No way I can compete with that.”

Fast-forward a year later. Guess who’s still standing? My client. Guess who shut down? The big fancy parlor.

What Happened?

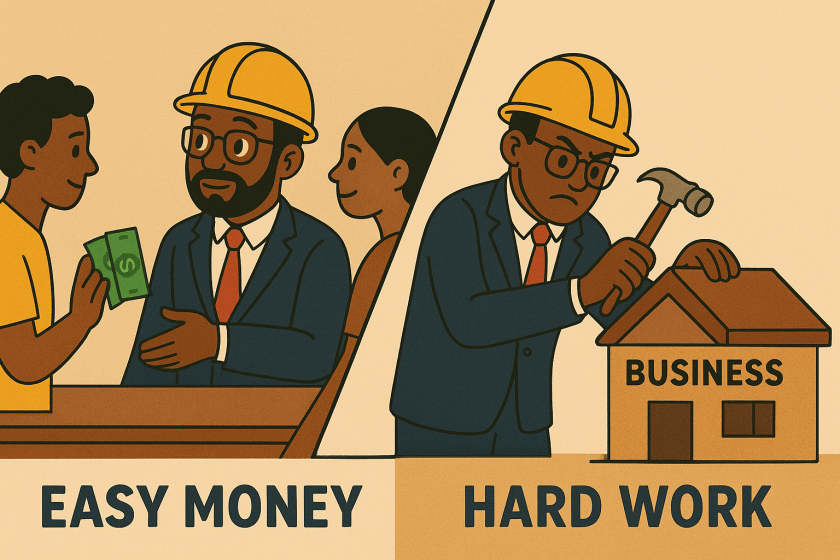

It’s simple. They suffered from what I call “The Curse of Easy Money.”

When you have access to too much money, you make stupid decisions that feel smart.

You solve every problem with cash.

You skip the grind of learning your customer.

You assume “big, shiny, premium” is what everyone wants.

But here’s the thing: money doesn’t build businesses—understanding does.

The False Confidence Trap

Having money at the start gives you false confidence.

You convince yourself:

- “If it looks premium, people will come.”

- “If I just spend more, I’ll outcompete everyone.”

- “If I build the biggest, I’ll be the best.”

Wrong.

Money hides your blind spots. It covers up your lack of customer insight. It makes you skip the hard lessons you only learn by starting small and growing slowly.

The fancy parlor thought every woman dreams of a luxury nail experience. Turns out, the women in that area just wanted affordability, speed, and reliability. No one asked for champagne with their pedicure.

The Power of Broke

Now, let’s flip it.

If that same owner had no money, what would’ve happened?

She would’ve started small. A few chairs. Basic setup. Nothing crazy.

She would’ve had no choice but to listen to customers, adjust, and improve.

She would’ve learned what women in that area actually wanted—before betting the farm.

That’s the power of being broke. It forces you to be smart, creative, nimble, and customer-obsessed.

Money lets you skip steps. Being broke makes you respect the process.

Why Easy Money is Dangerous

Easy money tricks you into thinking you’ve “figured it out.”

But what you’ve really done is build a house of cards.

And when reality hits—when customers don’t respond the way you imagined—your big, expensive setup becomes a heavy anchor dragging you down.

The more money you pour in upfront, the faster you sink when the cracks show.

Let’s Pull Into the Garage

Money isn’t evil. It’s a tool. And yes, it gives you options.

But here’s the harsh truth: starting out too comfortable is one of the worst disadvantages in small business.

Because the hustle isn’t built on marble floors and gold chairs. It’s built on customers who trust you, systems that work, and lessons you’ve earned the hard way.

So remember this: don’t let The Curse of Easy Money fool you.

Start lean. Stay hungry. Grow with sense.

And whatever you do, don’t assume throwing cash at your business will make it thrive. Because if money alone was the answer, every rich kid’s business would still be around.

Spoiler: they’re not.