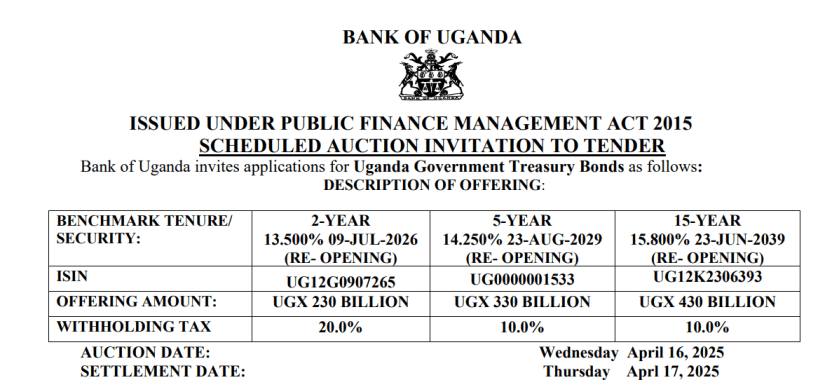

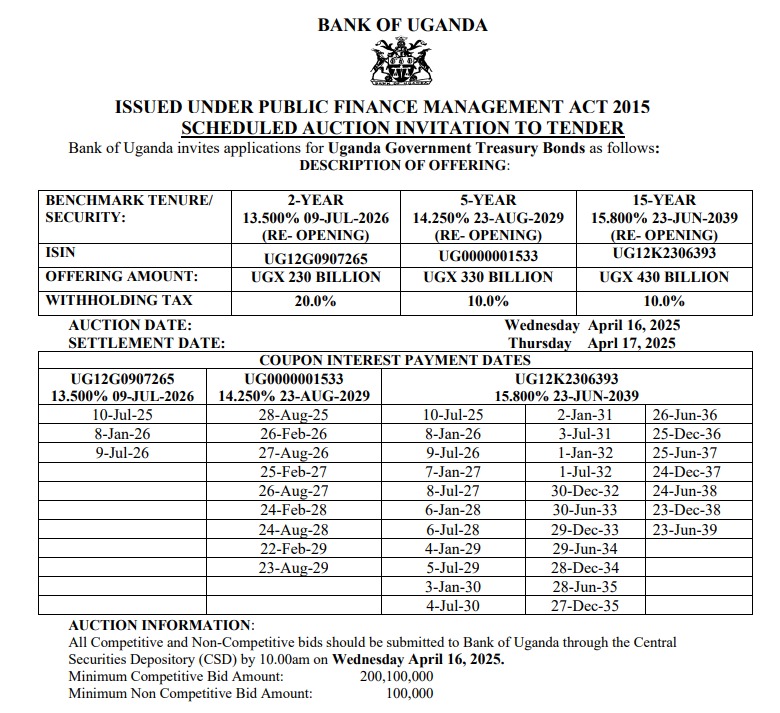

Bank of Uganda will be auctioning some bonds next week, as indicated in this press release. A treasury bond is simply a loan to the government, and it is considered one of the safest investments because governments rarely default.

A prudent investor would do well to have a portion of their asset portfolio in government bonds. The bonds provide some safety and a guaranteed income, unlike other asset classes. Bonds in Uganda also offer competitive returns without any hassle. This makes them a perfect asset class for corporate working people who don’t have the time and energy to run businesses on the side.

A good strategy with bonds is to find a lump sum and then invest in a long-term bond like the upcoming 15-year bond. This lump sum could be anything above ugx 5m but a larger amount is much better. Typically, you accumulate this lumpsum in a unit trust over a couple of months. You then reinvest the coupons or interest you earn every six months. Each time a coupon is paid, you add some cash to the coupon and reinvest it in another long-term bond.

So, you use your unit trust to continuously accumulate capital through regular monthly deposits. The unit trust is the collection account and then you gradually build a treasury bond portfolio. You need to ladder your portfolio with different bonds of different maturities and yields. The bonds in your portfolio need to be held to maturity while reinvesting all coupons. This allows the magic of compound interest to lift your portfolio to unbelievable heights.

Over time, this bond strategy is going to pay off. You have to be patient and disciplined and stick to the strategy. Don’t be distracted by naysayers and other seemingly juicy opportunities. Stick with this strategy for at least 5 to 10 years for it to have an impact on your finances.

At some point in time, your bond portfolio may start to pay you more than your job. This is your point of financial independence, and you can choose whether to stay on the job or not.

Treasury bonds are a competitive asset class, and I would definitely recommend everyone to have a portion of their funds invested in bonds.