One of the most common questions about retirement planning is, “How much should I save?” While the answer depends on your goals and circumstances, understanding the relationship between time, savings rate, and investment returns can provide powerful clarity.

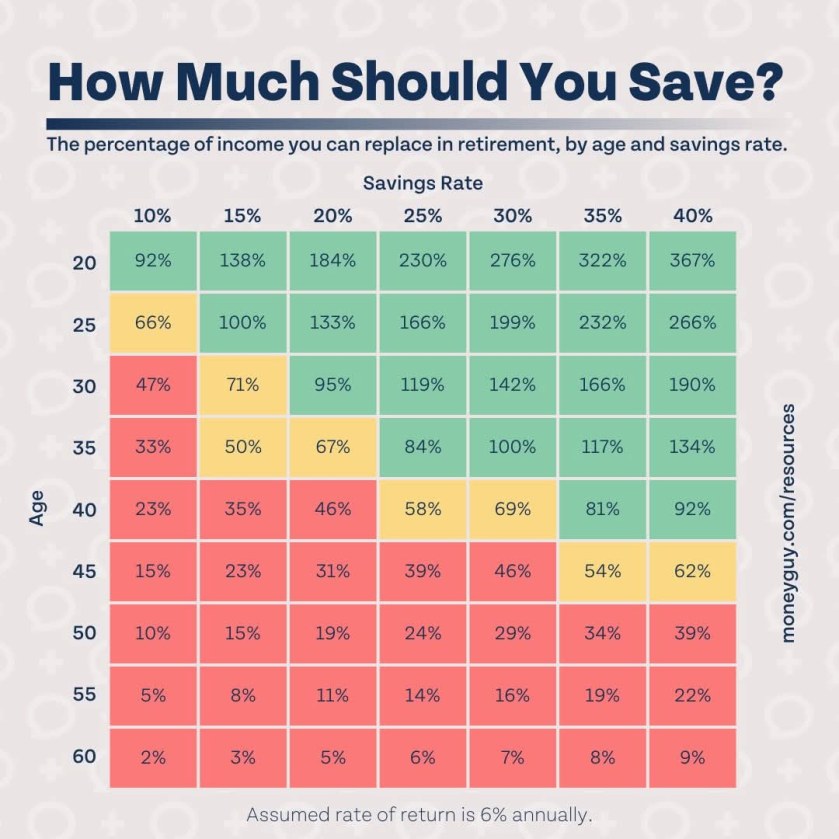

The chart above illustrates how much of your income you can expect to replace in retirement, depending on the age you start saving and the percentage of your income you save. It assumes a steady 6% annual return on investments and retirement at age 65.

The Power of Starting Early

The earlier you start saving, the easier your journey to financial independence. Let’s say you begin saving 20% of your income at age 20. According to the chart, by age 65, you’ll be able to replace 184% of your income. That means you’ll have almost double your annual income each year in retirement!

Compare this to starting at age 40. Even with the same 20% savings rate, you’ll only replace 46% of your income. The difference lies in the compounding power of time. When you start early, your money works for you longer, and the returns build on themselves like a snowball rolling downhill.

Higher Savings Rates = Bigger Retirement Cushion

If you want to retire comfortably or even generously, your savings rate plays a crucial role. Saving 40% of your income from age 25 could allow you to replace 266% of your income in retirement. This level of financial security provides freedom—freedom to travel, give generously, or leave a legacy for your family.

However, saving only 10% of your income starting at the same age limits you to replacing 66% of your income. While this might cover the basics, it may not leave much room for the lifestyle you envision.

Catching Up When You Start Late

Life doesn’t always allow us to start saving early, and that’s okay. What matters is recognizing where you are and adjusting accordingly.

For instance, starting at 50 and saving 10% of your income will replace just 10% of your income in retirement, even with a solid 6% annual return. To make up for lost time, you’ll need to dramatically increase your savings rate—up to 40%, which would replace 39% of your income.

The later you start, the more discipline and sacrifice are required. This might mean cutting back on current expenses or finding ways to boost your income, but it’s a worthwhile investment in your future.

Key Lessons for Everyone

1. Start as Early as Possible: Time is your greatest ally in saving for retirement. The earlier you begin, the less you’ll need to save each month.

2. Save Meaningfully: Aiming for a savings rate of 20–40% of your income can create a strong financial foundation and secure your retirement lifestyle.

3. Don’t Wait to Adjust: If you’re starting later, it’s never too late to make changes. Prioritize saving as much as possible to bridge the gap.

4. Stay Consistent: Whether you’re saving 10%, 20%, or 40%, consistency over time is crucial. Set your savings on autopilot and stay the course.

- Invest where you can earn high returns consistently. This chart assumes a return of 6% but the figures will be much better at a higher return of say 10%. Look out for safe investment vehicles which can give you a higher return over a long period of time.

Your Retirement Plan Starts Today

This chart is more than just numbers; it’s a map to financial independence. Take a moment to assess where you are on the journey and what adjustments you need to make.

Whether you’re 25 and just starting out, 40 and realizing you need to catch up, or 50 and determined to make the most of the years ahead, trust that with discipline, strategy, and perhaps a little guidance, secure retirement is within reach.

Let today be the day you take that first or next step toward securing the retirement you deserve. After all, your future self will thank you!