Introduction

Treasury bonds are one of the safest and most reliable ways to invest your money. Backed by the government, they offer a steady income stream through fixed interest payments over a specified period. If you’re looking for a low-risk investment that aligns with long-term goals like retirement or building wealth, treasury bonds could be the perfect fit for you.

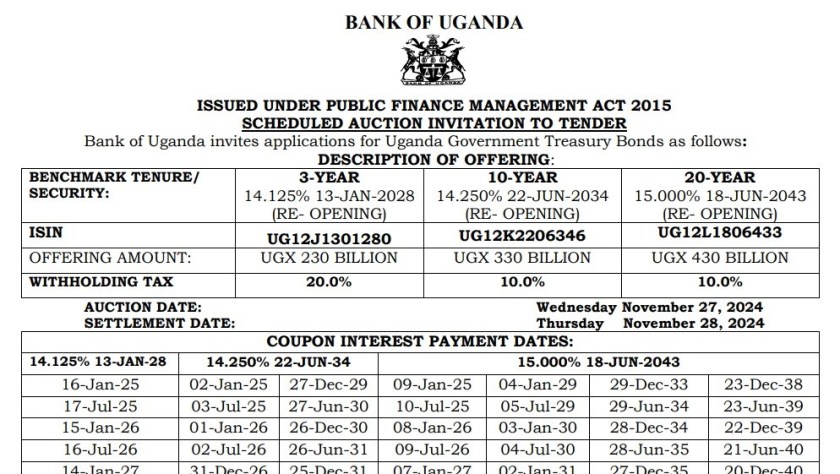

Right now, the Bank of Uganda has announced a scheduled bond auction for November 27th, 2024. The auction will offer three bond tenures: 3 years (14.125%), 10 years (14.25%), and 20 years (15.0%), with a total offering of UGX 990 billion. This is an excellent opportunity for investors to lock in predictable returns and participate in Uganda’s economic development. The minimum investment is just UGX 100,000, making it accessible for all.

With this call to bid, let’s dive deeper into what treasury bonds are, how they work, and how you can make the most of this opportunity.

What is a Treasury Bond?

A treasury bond is a type of debt instrument issued by the government to raise funds for public expenditure. When you buy a treasury bond, you’re essentially lending money to the government. In return, the government agrees to pay you periodic interest (referred to as a coupon) and repay the principal amount when the bond matures.

For instance, in the current bond auction, if you invest in a 10-year bond at 14.25%, you’ll receive fixed interest payments every six months for the next ten years. At the end of the term, your initial investment will be returned in full.

What is a Bond Auction?

A bond auction is the process through which governments sell treasury bonds to the public. In Uganda, the Bank of Uganda conducts these auctions every month. Investors can submit bids indicating how much they want to invest and the interest rate they prefer (for competitive bids) or accept the set rate (noncompetitive bids).

If your bid is successful, you are allocated bonds and begin earning interest based on the agreed rate. For example, if you participate in this auction, your interest payments for all these bonds will start as early as January 2025.

What are the Benefits of Bonds?

Treasury bonds come with numerous benefits that make them an appealing investment choice:

Safety and Stability: Treasury bonds are virtually risk-free since they are backed by the government. This makes them an excellent option for conservative investors who prioritize security over high-risk returns.

Predictable Income: Bonds provide regular, fixed interest payments, which create a steady income stream. This is especially useful for those planning for retirement, education for their children, or looking for passive income.

Tax Efficiency: For long-term bonds in Uganda, the withholding tax (WHT) on interest is just 10%, which is lower than many other forms of investment income.

Accessibility: With a minimum investment of UGX 100,000, treasury bonds are within reach for small investors, allowing anyone to start building wealth.

Long-Term Planning: Treasury bonds are ideal for achieving significant financial goals such as funding a child’s education, building a retirement nest egg, or buying a home.

Competitive Returns: Bonds in Uganda offer reasonable returns compared to their low-risk profile. For example, the 20-year bond currently offers a gross coupon of 15.0%. This return is both reliable and hassle-free compared to running a business or other ventures.

Potential Drawbacks of Bonds

While treasury bonds are a strong investment, it’s important to understand the challenges associated with them:

Potentially Lower Returns Compared to Other Investments: Bonds are safer than stocks or businesses but often yield lower returns over the long term globally. However, this tradeoff can be worth it for those seeking stability.

Inflation Risk: Over time, inflation can erode the purchasing power of your fixed returns. To mitigate this, reinvest your interest payments or diversify your portfolio to include investments that grow with inflation, such as equities.

Liquidity: If you need to sell your bond before it matures, you’ll have to find a buyer on the secondary market. While this is usually not a problem, it’s not as fast as liquidating a unit trust. However, selling a bond is still simpler than disposing of other assets like land or a business.

Credit Risk: While Uganda’s government bonds are still reliable, some foreign-currency-denominated bonds may carry more risk, as seen in countries like Greece and Ghana.

How Much Do I Earn When I Invest in Bonds?

The amount you earn depends on the bond’s coupon rate and the amount you invest. Importantly, the interest is subject to a 10% withholding tax for long-term bonds in Uganda. Here’s how your earnings would look after accounting for taxes:

Example: If you invest UGX 10,000,000 in the 20-year bond at 15%, your annual gross earnings would be UGX 1,500,000. After the 10% withholding tax, your net annual income would be UGX 1,350,000. Since bonds pay interest semiannually, you would receive UGX 675,000 every six months for the next 20 years. At the end of the 20 years, you will be paid back your principal of UGX 10,000,000.

What Strategy Can I Use to Build a Bond Portfolio?

1. Diversify Across Tenures: Spread your investments across short, medium, and long-term bonds to ensure a mix of stability and liquidity. For example, you could allocate funds to the 3-year, 10-year, and 20-year bonds in the current auction.

2. Invest a Lumpsum and Reinvest Earnings: Invest a Lumpsum and use the interest payments to buy more bonds or invest in other opportunities, allowing your wealth to compound over time.

3. Ladder Your Investments: By investing in bonds with staggered maturities, you ensure a steady cash flow and flexibility to reinvest. The idea is to have at least one coupon payment every month.

4. Focus on Tax Efficiency: Longer-term bonds in Uganda are taxed at a lower rate, which can significantly enhance your net returns.

5. Diversify across currencies: If you have a large portfolio, consider having a mix of local and foreign currency bonds from other countries to reduce the risk of exposure to a single currency.

How can a small investor buy bonds?

Investing in treasury bonds in Uganda is a straightforward process, even for small investors. First, you need to open a Securities Account, commonly called a Central Securities Depository (CSD) account, which can be set up with the Bank of Uganda through your commercial bank. Once your account is ready, you can explore the available bond offerings during primary auctions and choose one that matches your financial goals, whether short-term income or long-term growth. Next, decide how much you wish to invest and place your bid through your bank or a licensed broker. If your bid is successful, you’ll receive a contract note, and from that point, you’ll start earning regular interest payments, making it an excellent way to grow your savings over time.

Conclusion

Treasury bonds are a solid, low-risk investment option for anyone looking to secure predictable income and long-term financial growth. Whether you’re just starting or looking to diversify your portfolio, treasury bonds can provide safety, stability, and reliable returns. Of course, bonds should not be the only assets in your portfolio. A good portfolio should have a mix of assets with different return/risk characteristics so you can thrive in any economic situation.

With the November 2024 bond auction, you have a chance to participate in one of the safest investments available in Uganda. Take advantage of this opportunity to grow your wealth while supporting the country’s development. Remember, every big financial milestone starts with a single step—why not make yours an investment in treasury bonds today?