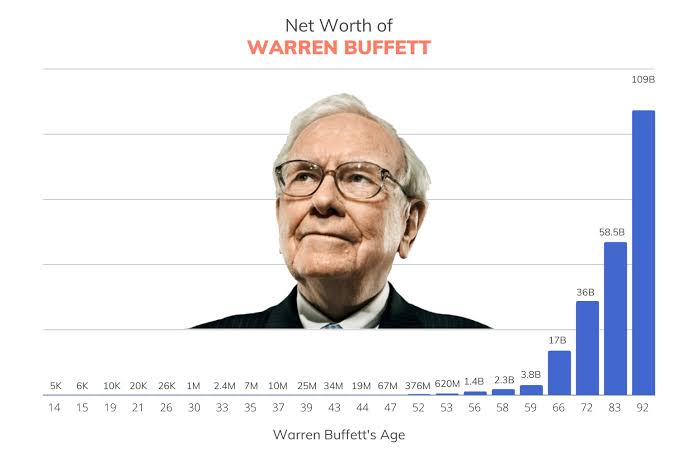

When we think about building wealth, it’s easy to get caught up in the idea of making quick money. The allure of instant success stories can make the slow, steady path seem less appealing. However, Warren Buffett’s journey to becoming one of the wealthiest individuals in the world is a testament to the power of playing the long game. Let’s dive into some insights we can glean from his incredible rise in net worth, as illustrated in the graph above.

Patience Pays Off

One of the most striking aspects of Buffett’s wealth accumulation is how modest his net worth was until his mid-50s. For decades, Buffett’s wealth grew slowly but steadily. It wasn’t until later in his life that his net worth skyrocketed, thanks to the magic of compounding. This teaches us an important lesson: patience and time are crucial allies in the journey to financial success.

The Power of Compounding

The graph shows a sharp increase in Buffett’s net worth in his later years, highlighting the power of compounding. Compounding is the process where the returns on your investments begin to generate their own returns. Over time, this effect snowballs, leading to exponential growth. The earlier you start investing, the more time compounding has to work its magic.

Continuous Learning and Adaptation

Buffett’s story is also one of continuous learning and adaptation. He didn’t stop educating himself about the markets, the economy, and the businesses he invested in. This commitment to lifelong learning allowed him to refine his investment strategies and make better decisions. For those of us looking to build wealth, staying informed and adaptable is key.

Consistency Over Time

Buffett’s wealth grew because of his consistent, disciplined approach to investing. He didn’t chase after the latest fads or try to time the market. Instead, he focused on investing in solid, reliable businesses. This consistency, paired with a long-term perspective, is a recipe for financial success.

Start Early, But It’s Never Too Late

Buffett started investing early, giving his money plenty of time to grow. However, the most significant growth in his net worth happened later in life, proving that it’s never too late to start investing. Whether you’re just beginning your financial journey or looking to improve your financial health, it’s important to remember that every step forward counts.

Invest in What You Understand

Buffett’s investment philosophy revolves around investing in businesses he understands and believes in. By focusing on areas where he has knowledge and confidence, he minimized risks and maximized returns. For aspiring investors, this approach can reduce uncertainty and increase the likelihood of making profitable investments.

Financial Discipline

Buffett’s disciplined approach to spending and investing is another cornerstone of his success. He avoided unnecessary risks and maintained a level-headed strategy, which allowed him to preserve and grow his wealth over time. Practicing financial discipline, such as budgeting and resisting impulse purchases, can significantly impact your long-term financial health.

Conclusion

Warren Buffett’s journey to immense wealth underscores the importance of playing the long game. By being patient, harnessing the power of compounding, continuously learning, staying consistent, starting early, investing in what you understand, and maintaining financial discipline, anyone can set themselves on a path to financial success. Remember, building wealth is a marathon, not a sprint. Embrace the long-term perspective, and let your investments grow steadily over time.