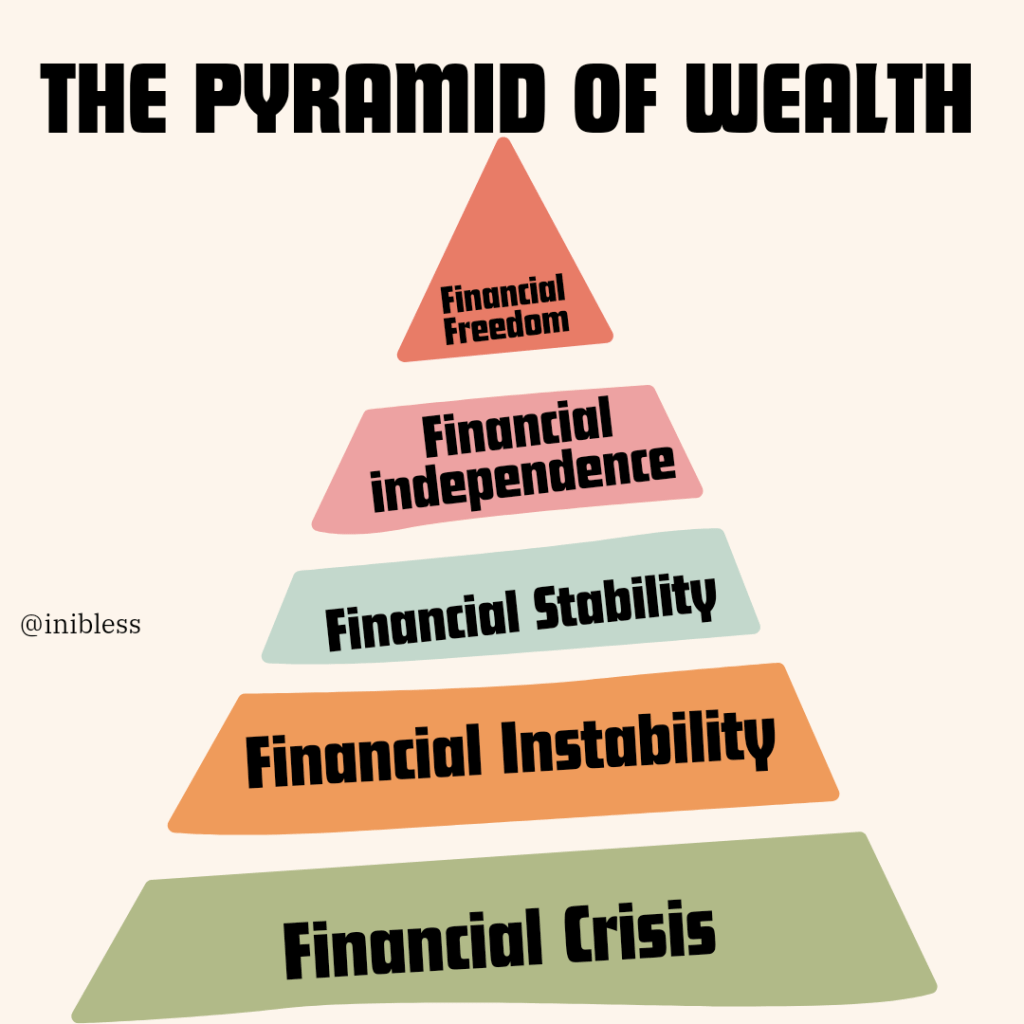

In the quest for financial success, many of us dream of reaching a state of financial freedom—a place where money is no longer a constant worry. But how do we get there? Imagine your journey to financial success as climbing a pyramid, each level representing a different stage of financial well-being. Let’s explore the Pyramid of Wealth and understand what it takes to move from financial crisis to financial freedom.

Financial Crisis

At the base of the pyramid lies the financial crisis. This stage is marked by a severe lack of money to meet even the most basic needs. If you’re here, you might be drowning in debt, facing constant bill collectors, or struggling to pay for essentials like food and shelter. You are most likely unemployed or underemployed at this stage. It’s a stressful and difficult place to be, but recognizing it is the first step towards climbing up.

The focus at this stage is survival. Start by assessing your financial situation, creating a bare-bones budget, and finding ways to cut expenses and build income. Take on whatever work you can find at this level. Consider upskilling yourself in more profitable trades. Seeking help from community resources or financial counseling services can provide immediate relief and guidance. The key is to stabilize your situation and begin to move forward.

Financial Instability

Once you’re out of crisis mode, you enter the realm of financial instability. Here, you may have some income, but it’s inconsistent or insufficient to cover all your needs and wants reliably. Unexpected expenses can easily throw you back into crisis. Your take-home pay is not sufficient to take you home.

In this stage, building an emergency fund is crucial. Aim to save at least $100 to $1,000 to cover unexpected expenses. Focus on increasing your income through additional work or finding a higher-paying job. Creating a budget that prioritizes necessities and starts to pay down debt will help establish a more stable financial foundation.

Financial Stability

Reaching financial stability means you can cover your basic needs and have a little left over. Your income is consistent, and you have a handle on your expenses. Debt might still be present, but it’s manageable, and you’re making regular payments towards it. However, this stage is quite deceptive because life is good, but tables can quickly turn in case you lose your job.

At this level, the goal is to solidify your foundation. Continue to build your emergency fund—aim for three to six months’ worth of expenses. Start contributing to retirement accounts and focus on paying off high-interest debt. Living below your means and avoiding lifestyle inflation will help maintain and strengthen your financial stability.

Financial Independence

Financial independence is the point where your money works for you. Your investments and passive income streams cover your basic living expenses, giving you more freedom to choose how you spend your time. You’re not entirely reliant on a paycheck from a job to meet your needs.

To achieve financial independence, increase your investments in diversified assets like stocks, bonds, and real estate. Maximize contributions to retirement accounts and consider additional investment vehicles. Creating multiple income streams, such as rental properties, dividend-paying stocks, or a side business, can accelerate your journey. It’s about building wealth that generates income on its own.

Financial Freedom

At the pinnacle of the pyramid lies financial freedom. This stage is characterized by complete financial security and the ability to live life on your terms. Money is no longer a constraint, and you can pursue your passions and interests without worrying about financial limitations. At this point, you are generous to worthwhile causes and focus on creating an impact in society.

Maintaining financial freedom involves wisely managing your wealth to ensure it lasts. Focus on preserving your capital, continuing to invest wisely, and perhaps giving back through philanthropy or supporting causes you care about. It’s also important to plan for long-term care and estate planning to protect your legacy.

Climbing the Pyramid

Moving up the Pyramid of Wealth requires dedication, discipline, and a strategic approach to managing your finances. Each stage builds on the previous one, creating a solid foundation for the next level. While the journey can be challenging, it’s also incredibly rewarding.

Remember, financial progress is a marathon, not a sprint. Celebrate your milestones along the way and stay focused on your long-term goals. By understanding and navigating each stage of the pyramid, you can create a path to financial freedom that offers security, independence, and the ultimate peace of mind.