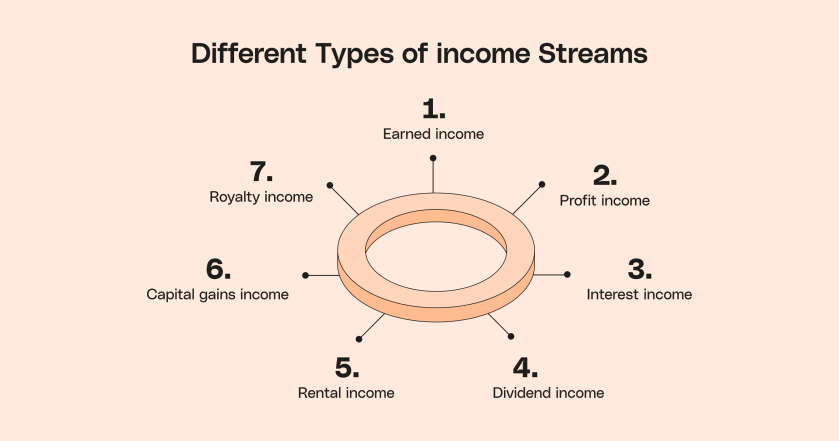

When we talk about income, most people think of their salary or wages from a job. But did you know there are actually seven different types of income? Diversifying your income sources can provide more financial stability and growth opportunities. Let’s break down these seven types:

1. Earned Income

This is the most familiar type of income for most people. Earned income is what you make from your job or active work. It includes your salary, hourly wages, tips, and commissions. It’s straightforward—trade your time and effort for money.

2. Profit Income

Profit income comes from selling goods or services for more than they cost you to produce. If you run a business, whether it’s a side hustle or a full-time enterprise, the money you make after covering your costs is your profit income. Consider turning a hobby or skill into a business to generate profit income.

3. Interest Income

Interest income is the money you earn from lending your money to others. This typically happens through savings accounts, bonds, or other fixed-income investments. Your bank might pay you interest for keeping your money in a savings account, or you might earn interest from bonds you’ve purchased.

4. Rental Income

If you own property and rent it out, the money you receive from your tenants is rental income. This could be residential real estate, commercial properties, or even renting out a room in your home. Rental income can be a steady stream of cash if managed well.

5. Capital Gains

Capital gains occur when you sell an asset for more than you paid for it. Common assets include stocks, real estate, and other investments. For example, if you bought shares in a company and the value of those shares increased over time, the profit from selling those shares is a capital gain.

6. Dividend Income

Dividends are payments made by companies to their shareholders as a reward for investing in their stock. Not all companies pay dividends, but those that do typically distribute them on a regular basis, providing shareholders with a stream of income.

7. Royalty Income

Royalty income is earned by owning and licensing intellectual property, such as patents, trademarks, or copyrights. For example, if you write a book, you can earn royalties each time a copy is sold. Similarly, if you invent something and patent it, you can license the rights to use your invention and earn royalties. If you have creative talents, consider writing a book, creating music, or developing a product that can earn royalties.

Relying on just one type of income can be risky. Diversifying can help cushion against economic downturns and provide multiple revenue streams. Moreover, multiple income streams can provide a safety net if one source dries up. Furthermore, different types of income, especially passive ones like dividends, interest, and royalties, can help you build wealth over time.

Understanding these seven types of income can be a game-changer for your financial planning. Building different income sources can open up new opportunities and lead to personal and professional growth.

So, start exploring different income streams to secure your financial future and build wealth more effectively.