Ray Dalio, the founder of Bridgewater Associates, a major hedge fund, often preaches about the importance of diversification in investing.

Diversification simply means spreading your investments across different types of assets instead of putting all your money into just one. Think of it like not putting all your eggs in one basket. So, instead of just buying stocks, you’d also invest in things like bonds, real estate, commodities, and more. The idea behind this is to lower the overall risk of your investments by not putting all your money in one place.

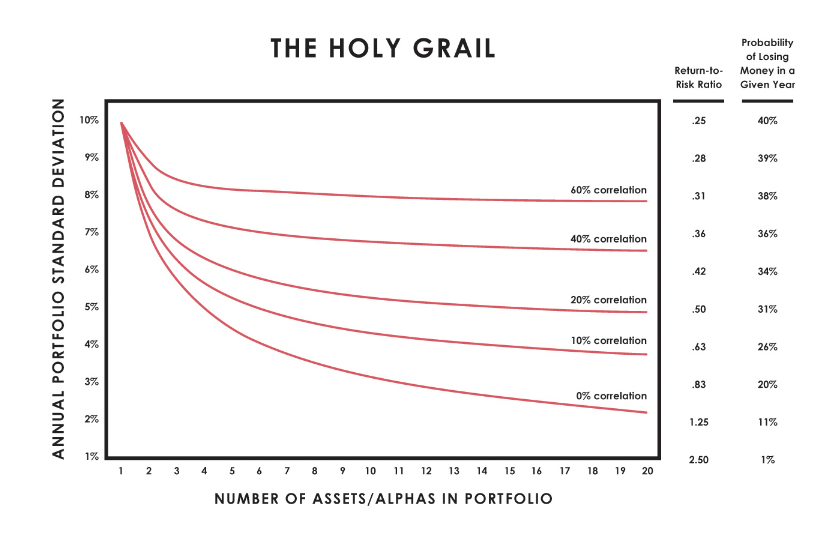

In a well-diversified portfolio, the assets should be non-correlated, meaning they don’t all move in the same direction at the same time. For instance, when stocks are down, bonds might be up, and vice versa. This helps smooth out the ups and downs in your overall investment performance, making it less volatile.

Adding more uncorrelated assets to your portfolio increases your return to risk ratio. This means you can expect similar returns but with lower risk. Dalio emphasizes the importance of considering the return you expect compared to the level of risk you’re comfortable with. By diversifying and ensuring non-correlation, you’re trying to make sure you get the most bang for your buck while keeping risk in check.

By spreading your investments across different assets and making sure they don’t all move together, you lower the chance of losing money while still aiming for good returns. Dalio suggests having at least 15 to 20 uncorrelated income streams in your portfolio to achieve this balance. The goal is to maximize returns while minimizing the overall risk of your investments.