Introduction:

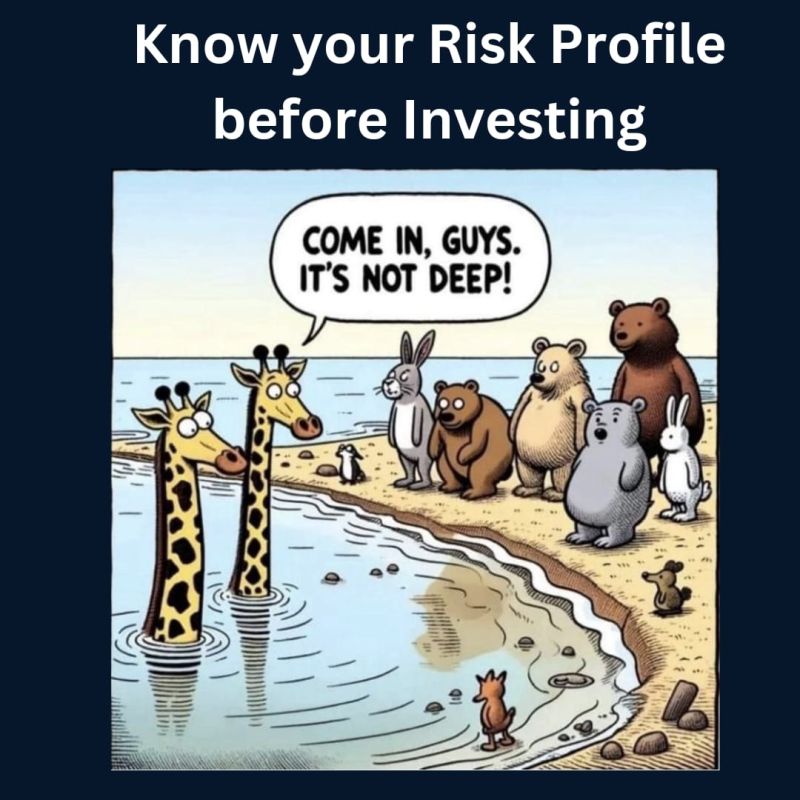

Investing can be a rewarding endeavor, offering opportunities for growth and financial security. However, it’s not without its risks. One of the most critical aspects of successful investing is understanding your risk profile. Your risk profile helps determine the types of investments that are suitable for you, aligning your financial goals with your tolerance for risk. In this blog post, we’ll delve into the importance of understanding your risk profile before diving into the world of investments.

What is a Risk Profile?

Your risk profile is essentially a measure of how much risk you are willing and able to take with your investments. It takes into account factors such as your financial goals, time horizon, income, expenses, and most importantly, your comfort level with market fluctuations. Understanding your risk profile is crucial because it forms the foundation of your investment strategy.

Determining Your Risk Profile:

Several factors influence your risk profile:

1. Financial Goals: Your short-term and long-term financial objectives play a significant role in determining your risk tolerance. Are you investing for retirement, buying a house, or funding your child’s education? Each goal may have a different risk tolerance associated with it.

2. Time Horizon: The length of time you have to invest is another critical factor. Generally, the longer your time horizon, the more risk you can afford to take because you have more time to recover from any market downturns.

3. Income and Expenses: Your current financial situation, including your income and expenses, can affect how much risk you’re willing to take. Someone with a stable income and low expenses may be more comfortable with higher-risk investments than someone with limited cash flow.

4. Knowledge and Experience: Your level of investment knowledge and experience also plays a role in determining your risk profile. Novice investors may prefer less risky options until they gain confidence and understanding of the market.

Types of Risk Profiles:

Investors are typically categorized into three main risk profiles:

1. Conservative: Conservative investors prioritize capital preservation over growth. They are typically risk-averse and prefer low-risk investments such as bonds, unit trusts, and money market accounts.

2. Moderate: Moderate investors seek a balance between growth and stability. They are willing to accept some level of risk in pursuit of higher returns but prefer a diversified portfolio that includes a mix of stocks and bonds.

3. Aggressive: Aggressive investors are comfortable with high levels of risk and seek maximum returns. They are willing to tolerate significant fluctuations in the market and often focus on high-growth opportunities such as stocks, real estate, and private businesses.

Why Understanding Your Risk Profile Matters:

Understanding your risk profile is essential for several reasons:

1. Aligning Investments with Goals: By knowing your risk tolerance, you can select investments that align with your financial objectives. This ensures that your portfolio is tailored to your needs and preferences.

2. Minimizing Emotional Decisions: Investing can evoke strong emotions, especially during periods of market volatility. Knowing your risk profile can help you make rational decisions based on your predetermined strategy, rather than reacting impulsively to market fluctuations.

3. Achieving Balance: A well-diversified portfolio is key to managing risk. Understanding your risk profile allows you to create a balanced investment portfolio that includes a mix of asset classes suited to your risk tolerance and financial goals.

4. Enhancing Long-Term Performance: Investing according to your risk profile can lead to better long-term performance. By staying invested and avoiding knee-jerk reactions to market movements, you give your investments time to grow and compound over time.

Conclusion:

Before embarking on your investment journey, take the time to understand your risk profile. By assessing your financial goals, time horizon, and risk tolerance, you can develop a personalized investment strategy that maximizes returns while minimizing unnecessary risk. Remember, investing is a marathon, not a sprint, and knowing your risk profile is the first step toward achieving your financial goals with confidence.