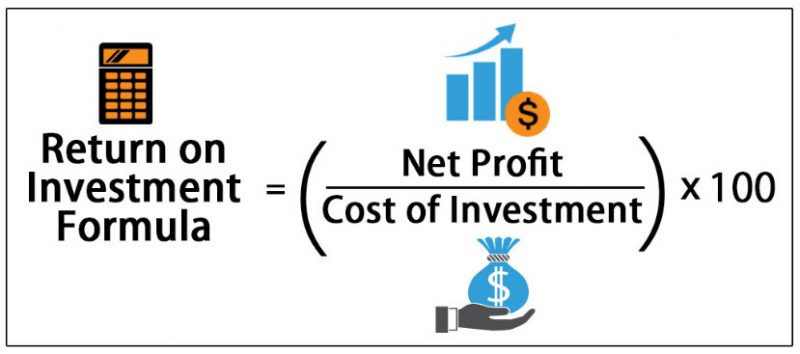

A typical metric to determine whether an investment is doing well or not is the Return On Investment (ROI). The Return On Investment is computed by dividing the profit from an investment by the total investment cost and then multiplying by 100%.

For example, imagine that you wish to build three 2-bedroom rental units on a 50*100 plot in Gayaza. The land costs you ugx 40m and each unit costs you ugx 100m to build. Each unit generates ugx 600k per month in rental income. So, to calculate ROI we first need to determine the gross annual revenues which is [3 units * 600k * 12 months] or ugx 21.6 million, assuming full occupancy throughout the year.

Then we need to estimate the costs of running the estate. Let’s say we have a guard whom we pay ugx 150k per month, and then we provide for some maintenance costs of 100k per month. So we spend about 250k per month or ugx 3m per year. There are also taxes to pay which is [12%*(21.6 – 2.82)] or ugx 2.25m.

So the annual profit from our investment is [21.6 – 3 – 2.25] or ugx 16.35m.

We now need to determine the investment cost which is the cost of the land plus the construction of the rentals which is [40 + 3 units * 100] or ugx 340m.

The ROI then becomes [(16.35/340)*100%] or 4.8%. We can add a 5% estimate for the property appreciation rate (net of building depreciation costs) which brings the total ROI to about 9.8%.

The question now becomes whether this is a good ROI or not. To do this we need to compare this ROI to other ventures where we could have put our money. A good comparison is the rate on an umbrella unit trust which is currently paying about 11% per year. You can also compare with the yield on a 10-year treasury bond which is about 15.5% or 13.95% after taxes. So from our scenario, the rental investment is not a financially better investment compared with a unit trust or a treasury bond.

This analysis should be done before you invest in anything. In our case, the prospective investor can do a couple of things to improve the return on their proposed project. They can for instance squeeze more units on the same plot of land. They can change location and attract higher incomes. They can closely supervise construction to reduce the investment cost. They can use a more economical architectural plan. They can use cheaper materials or alternative construction methods to lower the costs. Our investor can also decide that dealing with tenants is not worth his time and instead invests in a 10-year treasury bond with a superior return on investment for much less stress.

Whatever our investor decides to do, calculating the ROI on all feasible options will enable him to make a more informed investment decision.