Introduction

MTN Uganda Limited provides telecommunication and mobile financial services in Uganda.

MTN Uganda Limited was incorporated in 1998 and is headquartered in Kampala, Uganda, and has over 1,262 employees. MTNU is a subsidiary of MTN International (Mauritius) Limited. MTNU was listed on the Uganda Securities Exchange in December 2021.

Share price performance

MTN Uganda is currently trading at ugx 170 on the Uganda Securities Exchange which is 15% below the IPO price of ugx 200.

Dividends

The current dividend yield is about 6.6%, with a payout of 84%. MTN’s dividend yield is higher than the bottom 25% of listed stocks in Africa but lower than the top 25% of listed stocks in Africa. Analysts forecast a yield of 14% in three years.

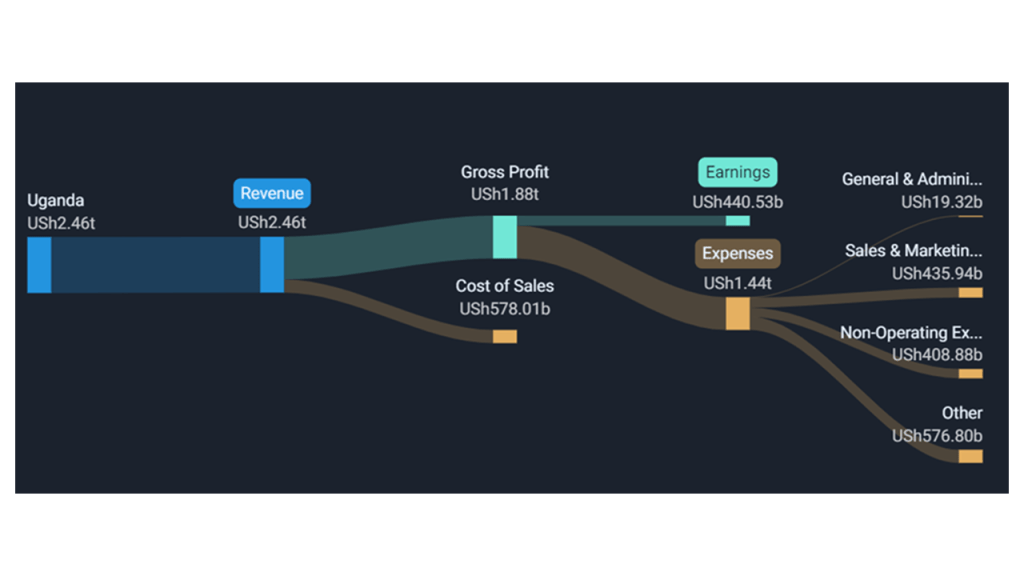

Financial Performance (based on Last Twelve Months, from June 2023)

MTN Uganda is highly profitable with net profits of ugx 440.53bn. Gross revenues, including mobile money revenues, were ugx 2.6 trillion. This represents a net margin of 17.9%, with past earnings growing at 17% per year. Revenues have been growing at an average rate of 13.8% per year. MTN Uganda’s return on equity is 43.7%, and the return on capital employed is about 40%. These metrics point to how effectively the company is using its capital to generate profits for investors.

Valuation

MTN Uganda has a price/earnings (p/e) ratio of 8.6x, which is comparable to Safaricom (8x). It’s price/book (p/b) ratio is 3.8x compared to Safaricom’s (2.7x). These metrics show how the current share price compares with earnings per share and book value, respectively. The higher the metrics, the more expensive the stock is. We estimate MTN Uganda’s fair value to be about ugx 285.6 per share, which implies that the stock is about 40.5% undervalued. This valuation is based on a two-stage discounted cash flow analysis based on projected future free cash flows. It doesn’t factor in the fact that the mobile money business is likely to be divested from the telecom business, as indicated in the prospectus.

Conclusion & recommendation

MTN Uganda is one of the largest and most profitable companies in Uganda. It generates over ugx 2.5 trillion in revenues with over ugx 440bn in profits. Revenues are forecast to grow at over 10% per year. MTNU is currently trading at ugx 170 on the Uganda Securities Exchange, which is a 15% drop from the IPO price. The stock is currently trading at about 40.5% below its fair value estimate, and we anticipate that the price will rise in the long term to reflect the underlying profitability of the company. The telecom sector in Uganda is still growing, with voice and data becoming essential to our everyday lives. This, coupled with a young and growing population, points to a profitable business environment in the long run.

We recommend that investors with a long-term view add MTN Uganda to their investment portfolios.