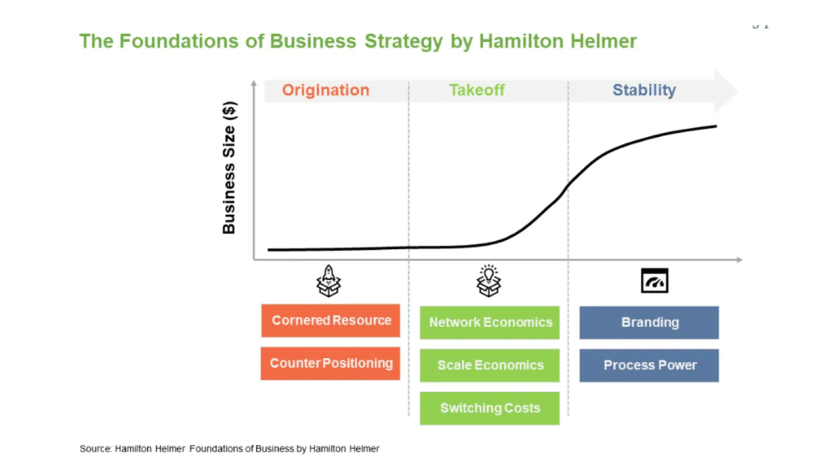

The book “7 Powers: The Foundations of Business Strategy” by Hamilton Helmer provides a framework for understanding and achieving a lasting competitive advantage in business. The seven powers are:

1. Scale Economies: This refers to the cost advantages a business gains due to increased levels of output. For example, Walmart uses its enormous scale to negotiate better prices from suppliers, which allows it to offer lower prices to consumers.

2. Network Economies: This is when the value of a product or service increases as more people use it. Social networks like Facebook and LinkedIn are prime examples; the more people who use them, the more valuable and indispensable they become.

3. Counter-Positioning: A new entrant takes a unique position that makes it difficult for existing competitors to respond without losing their existing advantage. For instance, Netflix’s streaming service made it difficult for traditional cable TV services to compete without overhauling their business models.

4. Switching Costs: This refers to the costs (time, money, effort) involved for a customer to switch from one product or service to another. Software services like Adobe’s Creative Cloud keep customers by integrating multiple services, making it cumbersome and costly to switch to alternative products.

5. Branding: The process of creating a unique image and name for a product in the consumer’s mind. Apple is a classic example, with its brand associated with innovation, quality, and luxury. This allows Apple to charge premium prices.

6. Cornered Resource: This involves having exclusive control over a rare resource. For example, De Beers had a near-monopoly over diamond mines for a long time, allowing them to control the supply and pricing of diamonds.

7. Process Power: This is when a company has unique processes that allow it to produce goods or offer services more efficiently than competitors. Toyota’s lean manufacturing is an example, which allows it to maintain high quality while reducing costs.

How can startups leverage these powers to capture a market?

Startups can use the “7 Powers” framework to identify which of these levers could be the most impactful in their specific industry or niche. Here’s a simplified approach:

1. Scale Economies: Initially, focus on rapid growth to reach a level where unit costs decrease. Utilize economies of scale to offer better prices or higher quality, attracting even more customers.

2. Network Economies: If your product or service becomes more valuable as more people use it, aim for viral growth. For example, a social platform or a marketplace startup could benefit greatly from network effects.

3. Counter-Positioning: Identify weaknesses in the incumbents’ value proposition and offer something uniquely different. Uber did this with traditional taxi services, offering more convenience, transparency, and sometimes lower prices.

4. Switching Costs: Create a product that, once adopted, becomes deeply integrated into your customers’ lives or workflows. For instance, develop a software solution that stores a lot of user data, making it inconvenient for them to switch.

5. Branding: Build a strong, recognizable brand from day one. Even if you’re small, a strong brand can create a perception of quality and reliability, attracting more customers.

6. Cornered Resource: Secure exclusive contracts or proprietary technologies that set you apart. If you can lock down a resource, whether it’s talent or raw materials, that your competitors can’t access easily, you’ll have a distinct advantage.

7. Process Power: Develop unique processes that allow you to operate more efficiently or deliver a better product. For instance, if you can develop a manufacturing process that significantly reduces the cost of production, you can undercut competitors on price while maintaining margins.

Startups should choose one or two of these powers that are most aligned with their capabilities and market conditions and focus intensely on developing them. Over time, as the business scales, they can diversify into leveraging other powers to fortify their market position.