Risk is the possibility of loss when you invest. Great investing is about getting a good return with minimal risk. This means we can’t evaluate any investment best on potential return alone. We should also consider how much risk is being incurred.

Sports betting can be lucrative but it bears too much risk because of the low probability of winning. The problem is that society praises winners without any consideration to the risk incurred. Someone who wins big in goat farming is paraded for all to see without regard to all the risks inherent in farming.

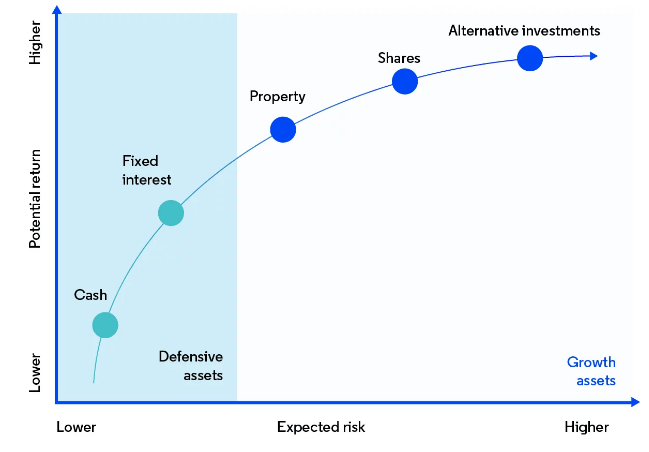

There is a so called capital market line which can be used to represent the relationship between risk and return. Generally the higher the risk, the higher the return. The capital market line generally slopes upwards to the right as risk increases. Investors need an additional return in exchange for taking on more risk.

We can think of cash and cash like assets like unit trusts bearing the least risk in our capital markets. Fixed income securities like treasury bonds and bills have a bit more risk (inflation + credit default) and hence pay a little higher than unit trusts. Property and real estate have more risk than unit trusts and bonds. The risks in real estate include liquidity risk and demand risk (including tenancy stress). So someone venturing into real estate should demand a higher return than they would get from a treasury bond.

Shares are more risky compared to unit trusts, bonds, and property. With shares the prices can fluctuate and dividends depend on underlying business performance. So an additional return should be demanded by equity investors.

Alternative investments like private equity, business, private lending, crypto currency, forex trading, etc. present the highest risks for an investor. The potential return must more than offset the potential risks presented by such investments. Alternative investments also have the additional headache of requiring your personal involvement and time to make them work. For example a farming venture requires your close supervision to be profitable and must therefore generate a higher return than I would ordinarily get from a treasury bond. Same thing with any private business I undertake.

The ability to understand and control risk can, however, present lucrative opportunities to whoever understands it. Typically, investing within your circle of competence can lower incompetence risks associated with investing. Remember that all investing generates some risk and the idea is not to eliminate all risk but to take calculated risks.