1 Introduction

This essay provides an analysis of the Airtel Initial Public Offering based on my interpretation of the authorized prospectus. The information contained herein doesn’t not amount to financial advisory. Investing in shares in risky and you may lose your capital. Please retain the services of an investment professional for personalized financial advice. I have done my best compile this analysis and any errors or omissions are regrettable.

The detailed prospectus can be found at https://www.airtel.co.ug/ipo-ug

2 Offer details

Bharti Airtel Uganda is offering for sale 8,000,000,000 ordinary shares (20% of the company), with a par value of UGX 1 each, in the share capital of Airtel Uganda at an offer price of UGX 100 per offer share on the Uganda Securities Exchange.

The minimum number of Offer Shares for which Application must be made is 2,500 Offer Shares. Applications for greater than this minimum must be in multiples of 500 Offer Shares with no limit on the number of Offer Shares that an Applicant can apply for.

The proceeds of the IPO will accrue to the selling shareholder, Bharti Airtel Uganda.

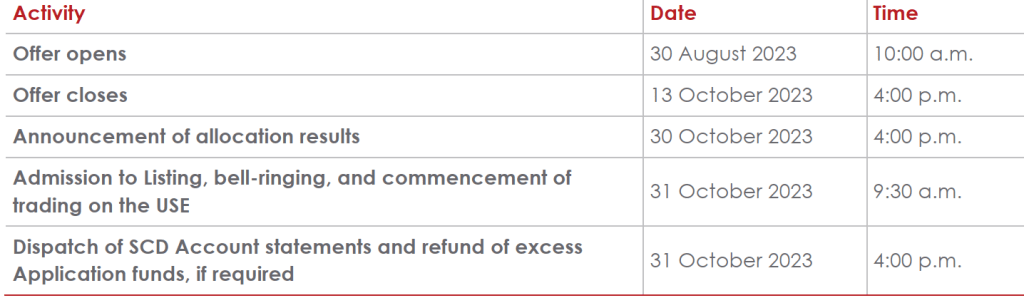

3 Offer timetable

4 Offer statistics

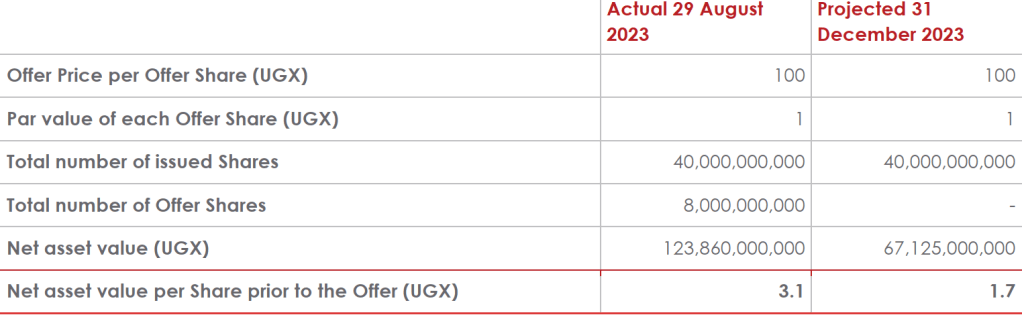

5 Incentive shares

5 Incentive Shares are being offered to retail investors for every 100 Sale Shares allocated. An additional incentive share is being offered for retail investors who use Airtel Money to buy shares (*185*85#)

6 Business overview

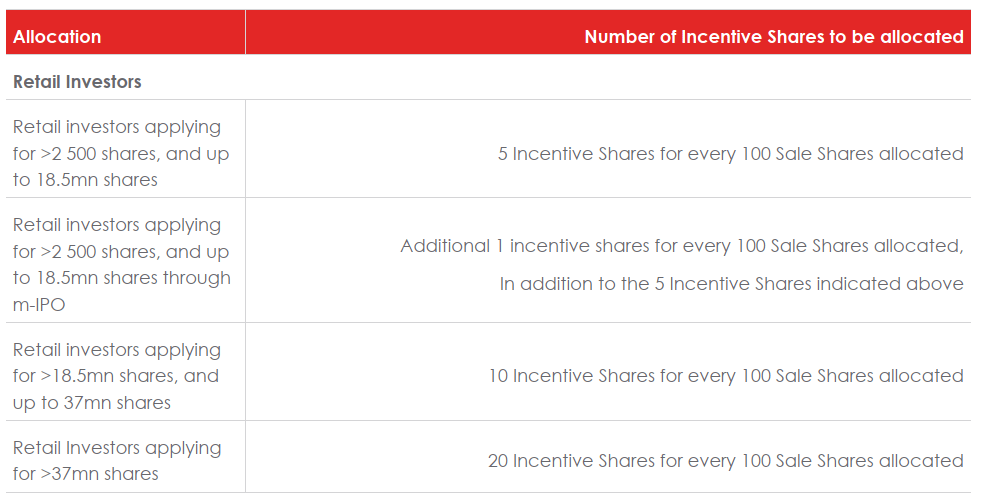

6.1 Ownership structure

Airtel Uganda is owned by Bharti Airtel Uganda Holdings (>99.99%) and Bharti Airtel Africa (0.00007%).

6.2 Primary Business

The Company’s current subscriber base consists almost exclusively of pre-paid subscribers, who accounted for approximately 99.8% of the Company’s total subscriber base as at 31 December 2022. In December 2021, the Company had approximately 12.6 million subscribers and by December 2022, this figure had grown to 13.8 million, translating to approximately 8.5% growth in subscriber base year-on-year. The Company’s post-paid customers are corporate and small-to-medium-size enterprises, representing 0.2% of the total subscriber base as at December 2022.

Given the subscriber composition, the Company’s products and services primarily cater to the pre-paid market. For the Ugandan market, the Company offers affordable voice tariffs with per second billing, Internet Services, SMS, USSD, one network and affordable SIMs. The Airtel Mobile Money division is excluded from the Company shareholding structure and does not form part of this Offer. The Company has also developed select products and services for the post-paid market including Corporate pre-paid and post-paid, Broadband, Closed User Group (CUG), Contract Handsets, Private APNs, Toll Free Services, home data solutions (FTTH), sponsored data, and Roaming packages.

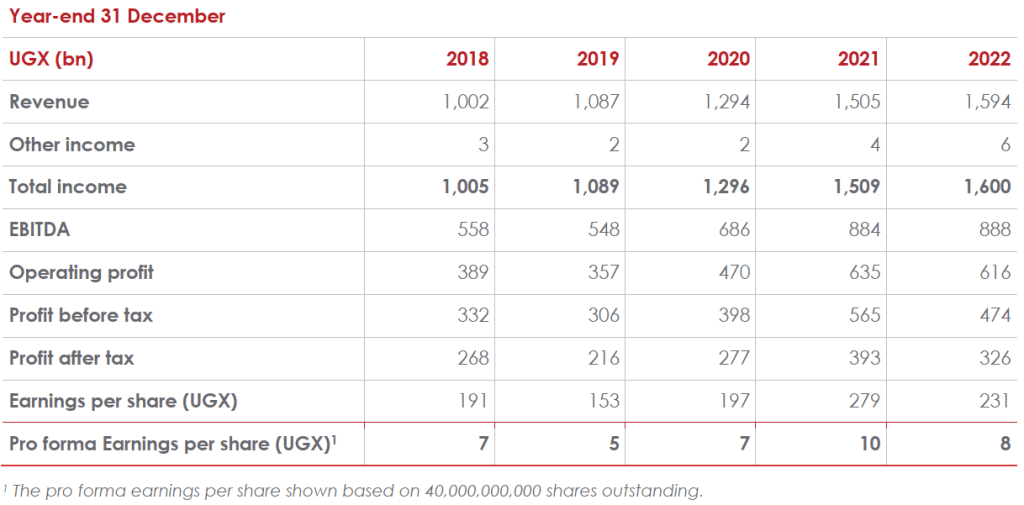

7 Financial Performance

7.1 Profitability

Airtel is profitable with an EPS of ugx 8 in 2022.

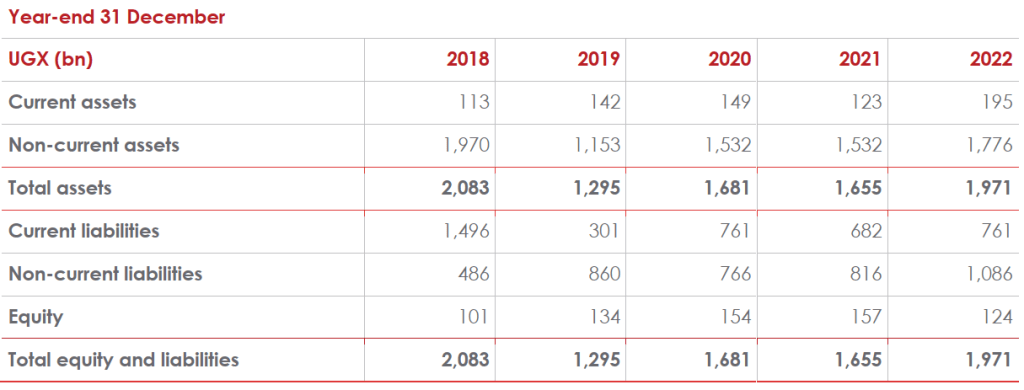

7.2 Net assets

Airtel has a positive equity with a relatively high proportion of debt in its capital structure.

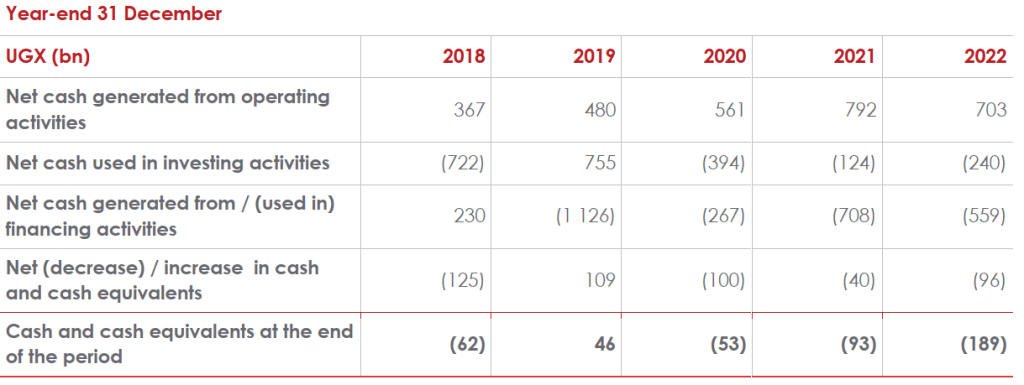

7.3 Cashflow

Airtel has a negative cash flow and a negative cash balance mainly because of the relatively high levels of debt.

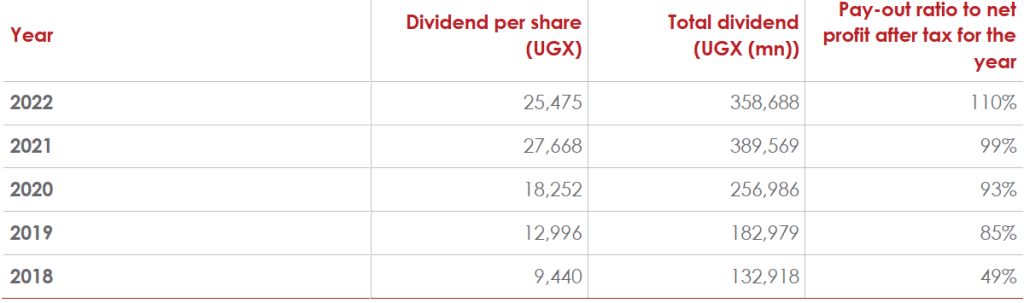

7.4 Dividend Payout

Airtel Uganda has a good dividend policy. In the prospectus Airtel projects a dividend of about ugx 500bn for 2023 which will be paid quarterly. Airtel is promising to pay 95% of profits in dividends going forward. The quarterly dividend is a very good incentive for investors who need a regular cash flow. I find Airtel’s dividend policy to be one of the best attractions in this IPO.

7.5 Profit forecast

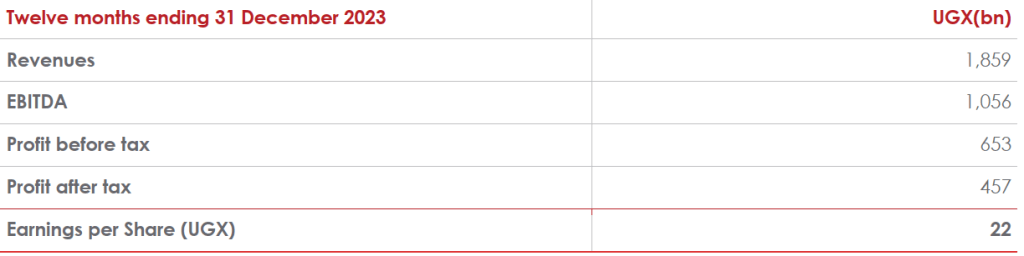

Airtel is projecting net profits of ugx 457bn and a dividend payout of ugx 500bn in 2023.

7.6 Comparison with MTN

After a comprehensive analysis of Airtel and MTN Uganda’s financial performance, several insights emerge. In terms of market share, Airtel trails closely behind MTN with similar revenues. While MTN’s earnings are enhanced by its mobile money platform, Airtel’s IPO doesn’t consider Airtel Money, suggesting MTN’s stronger monetization of its mobile money segment. Interestingly, Airtel’s relatively higher IPO price (compared to book value) and P/E ratio may signal the company’s optimistic outlook on its future earnings and growth potential.

However, Airtel’s financials reveal higher short-term liabilities compared to short term assets, indicating liquidity concerns and a greater reliance on debt. This could lead to heightened interest costs, potentially impacting profitability. Despite this, Airtel’s consistent ability to service its debt obligations from regular revenues underscores its robust operational performance. Additionally, Airtel’s negative cash flows, a result of its aggressive dividend strategy and capital investments, may pose growth sustainability challenges.

From an investment perspective, while Airtel’s high Return on Equity (ROE) and Return on Capital Employed (ROCE) reflect efficient capital utilization and return generation, its leverage might be a double-edged sword, amplifying losses. Finally, the similarity in dividend yields between the two telecom giants suggests comparable income prospects for shareholders.

(refer to table below for details)

| Metric (Dec 22) | Airtel (U) | MTN (U) | Comment |

| Revenue (ugx) | 1,600bn | 1,610bn | Airtel is a very close second to MTN in market share |

| earnings per share (eps) | 8.15 | 18.14 | MTN has a stronger earnings per share because of MOMO (Airtel Money has been excluded from the IPO) |

| book value per share | 3.1 | 40.4 | |

| offer/share price | 100 | 170 | Airtel’s IPO price seems relatively high compared to MTN’s share price |

| price/earnings | 12.3 | 9.4 | Airtel has a higher p/e ratio compared to MTN |

| price/book | 32.3 | 4.2 | Airtel’s valuation seems higher compared to MTN |

| current ratio | 0.26 | 0.82 | Airtel’s short-term liabilities exceed its short-term assets, implying increased reliance on debt to finance its operations. |

| debt/equity | 1065.46% | 146.26% | Airtel has relatively large levels of borrowings and lease liabilities |

| net cashflow per share | -2.41 | 0.53 | Airtel has posted negative cashflows owing to aggressive dividend payments, and capital expansion. |

| interest cover | 11 | 10.43 | despite relatively high leverage, Airtel can comfortably meet its debt obligations from recurrent revenues |

| dividend payout | 110% | 88% | Airtel has a stronger dividend payout policy which is a good thing for investors |

| return on equity (ROE) | 262.90% | 44.92% | Airtel’s return on equity is high because of relatively higher levels of leverage |

| return on capital employed (ROCE) | 16.54% | 10.23% | Airtel Uganda has a higher ROCE compared to MTN Uganda |

| dividend per share | 8.9672 | 15.9 | |

| dividend yield | 9% | 9% | Airtel has a similar dividend yield to MTN |

8 Key Risks

- Valuation risk. The offer price is about 32 times book value compared to MTN which is about 4 times. This may imply that Airtel maybe overvalued compared to its peer. The risk is that prices may fall after IPO to reflect a reasonable valuation. It’s also important to recognize that Airtel Money is NOT part of the IPO offering.

- Liquidity risk. Airtel’s current liabilities exceed its current assets meaning the company may have to rely on debt to finance its working capital needs. Airtel is also cash flow negative and has a negative cash balance as opposed to MTN which generated a positive cash flow and closed with a positive cash balance in 2022.

- Price may plunge after IPO. The share prices may drop after IPO just like we saw with Safaricom, CIPLA and MTN. This could be because of over valuation of the company at IPO and reduced demand of the shares post IPO.

- Dividend payout maybe lower than projected. This could be because of reduced profitability because of excessive competition with MTN and other providers. It could also be because of failure to raise additional capital to pay dividends.

- Large levels of debt. Airtel’s debt levels are relatively high compared to MTN. This large debt levels increase the financial risk of buying shares in Airtel as lenders will demand repayment first in case of default. However, Airtel is profitable and is able to service its loan repayments.

9 How to apply for shares

You can apply for shares through Airtel Money (*185*85#); through your registered broker; or through the USE portal (https://scd.use.or.ug/)

10 Conclusion

From the given information, Airtel Uganda’s decision to make an Initial Public Offering (IPO) is a significant financial event in the Ugandan capital market. The IPO is inviting Ugandan investors to participate in the ownership of a notable corporate entity in the country. By offering 20% of its share capital to the public, Airtel Uganda provides an opportunity for Ugandans to diversify their investment portfolios with a stake in one of the country’s largest and profitable enterprises.

The offer price of UGX 100 per share might seem high, especially when compared to MTN. This premium could be based on several factors including; Growth prospects, Brand recognition, Current and expected profitability, and, any strategic moves Airtel is planning.

The ability to invest through Airtel Money or a broker makes the IPO accessible to a wider range of investors. Using Airtel Money for this purpose could also encourage more Airtel users to consider the IPO.

While the opportunity is appealing, there are notable risks:

>Debt Levels: A higher proportion of debt in its capital structure can enhance the returns on equity, but it also increases the company’s financial risk. Higher debt implies that the company has more obligations to meet, which can be challenging in economic downturns.

>Cash Flow: Being cash flow negative indicates that the company spends more than it brings in during a particular period. While this isn’t always a bad thing (it could be due to significant investments for future growth), persistent negative cash flow can be concerning, especially if paired with high debt levels.

MTN, which is less leveraged and with positive cash flows, seems to have a more conservative financial stance. This might appeal to risk-averse investors. Airtel’s financial situation might be geared towards aggressive growth, which might suit investors with a higher risk tolerance and a longer investment horizon.

Overall, Airtel appears to have a more aggressive financial strategy compared to MTN, utilizing leverage and maintaining a strong dividend policy. This can be advantageous for investors seeking higher returns, but it also entails greater risk. On the other hand, MTN, with its MOMO earnings, appears to have a steadier revenue stream. Investors should consider their risk tolerance, time horizon, and investment objectives before making a decision.

11 Recommendation

Before making an investment decision, it’s crucial to thoroughly understand the company’s financial health, its business model, growth prospects, industry dynamics, and other relevant factors.

Never put all your eggs in one basket. If you decide to invest in Airtel, make sure it fits well within your diversified investment portfolio. I would recommend investing a portion of your capital in this IPO with a long-term view (>10 years). For those who can afford a minimum investment of ugx 10m is reasonable, otherwise ugx 250k is sufficient to start with.

Consider consulting a financial advisor or investment expert to gain more insights into the IPO and its implications for your personal financial goals.

Remember, all investments come with risks. It’s essential to balance the potential returns against these risks to make informed decisions.