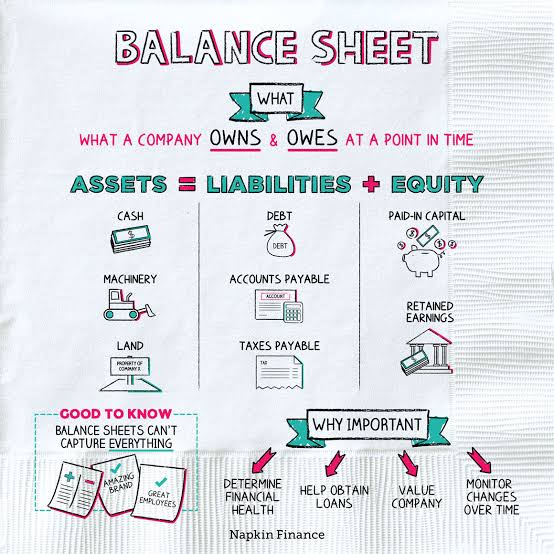

A balance sheet is one of the main financial statements used by businesses and individuals to keep track of their financial health. To simplify things, think of a balance sheet as a snapshot of what you own, what you owe, and what’s left over at a specific point in time. Here are its three key elements:

- Assets: These are things you own that have value. For a person, this might be your house, car, cash in your bank account, or investments like stocks and bonds. For a business, this could include cash, inventory (products ready to be sold), buildings, equipment, and money owed to them by customers (accounts receivable).

- Liabilities: These are things you owe to others. For a person, this might be a mortgage, car loan, student loan, or credit card debt. For a business, liabilities might include loans from banks, unpaid bills to suppliers, salaries owed to employees, or taxes owed to the government.

- Equity (or Owner’s Equity for businesses, or Net Worth for individuals): This is what’s left over when you subtract your liabilities from your assets. If you were to sell off all your assets and pay off all your debts, equity is what you’d have left. For a business, this is often called “shareholder’s equity” and includes the money originally invested into the business plus any retained earnings (profits kept in the business and not paid out to shareholders).

So, the balance sheet gets its name because it shows that these three elements are in balance according to the fundamental equation:

Assets = Liabilities + Equity

This means that everything you own (assets) is either financed by borrowing (liabilities) or by your own money (equity).

Understanding a balance sheet can give you a good idea of your financial health or the health of a company at a given moment in time. It’s like a financial snapshot. For individuals, having more assets and less liabilities generally means you have a positive net worth, which is a good sign of financial health. For a business, having sufficient assets to cover its short and long-term liabilities is an important indicator of financial stability. Tracking your net worth or equity over time will give you an indication of whether you are building wealth or not.

A good personal balance sheet should have income generating assets. If not one is bound to be asset rich and income poor. Sooner or later the assets are sold off (inevitably at less than market price) to generate income to meet short term emergency demands.

LikeLike