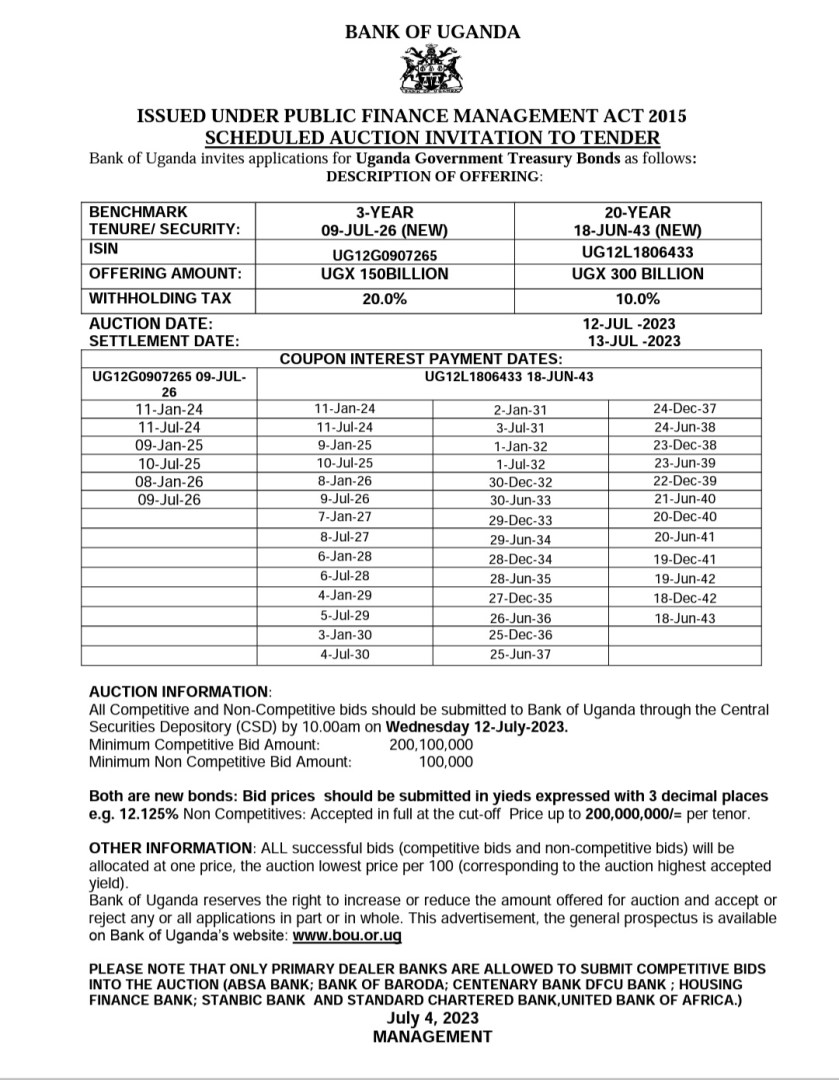

The government is offering to raise ugx 150 bn in a new 3 year bond and ugx 300bn in a new 20 year treasury bond on Wednesday 12th July 2023.

Treasury bonds are some of the safest and high yielding investments in our economy because you are lending to the government which rarely defaults. Since the bonds are issued in local currency the government can just print more cash or simply increase taxes to pay you back. Bonds are also hustle free. There are no tenants to deal with like in rentals or the myriad of problems experienced by the typical business owner or farmer. You just invest, sit back, relax, and the government pays you every six months like clockwork. Bonds are especially good for professionals and employed people who neither have the time nor the skills to run a side hustle. I mean, why should you struggle with a loss making goat farm in the village yet you can invest in bonds on your phone from the comfort of your office?

The bonds are liquid and you can easily sale them unlike real estate where you struggle to find buyers for your property. It is very easy to scale up your investment as long as you have capital. Expanding a business is not so obvious!

The main problem with bonds is inflation. This can be mitigated by reinvestment of the coupons you receive every six months in shares and other assets like unit trusts and land. This way you keep ahead of inflation and diversity your portfolio.

Minimum investment requirement is 100k but it makes more sense to buy in bulk to realise some tangible returns.

If you are interested in investing in treasury bonds, talk to your bank or registered broker.

Is it safer to buy bonds on the secondary market? Sometimes on the primary market, the cut off pricing after an auction is high so you end up paying some unexpected costs to purchase a bond.

LikeLike